Editor’s Note: The following information is from the Highland School District and is an attempt to answer questions regarding the upcoming public meeting and purpose of the proposed millage increase.

The Highland School district has always taken pride in ensuring students have safe, encouraging learning environments. In recent years, they made improvements including increasing safety at building entryways, elementary school renovations, and parking lot improvements to name a few.

Earlier this year, the district was granted $6.3 million in partnership funding from the Commission for Public School Academic Facilities and Transportation to be allocated toward the construction of a much-needed new high school. To receive these funds, the district must fund its portion of the project. The current millage rate of 30 mills, the third-lowest rate in the state, does not generate enough budget to contribute to such a significant and necessary project. Therefore, the Highland School District Board and Administration are requesting an 8.9 mill increase for the construction of a new high school, bringing us to a millage rate that falls within the state’s average.

The district plans to share information so that voters can make an informed decision on their November 8 ballot.

When is the 2022 Election?

The 2022 Election will take place on Nov. 8 from 7:30 a.m. to 7:30 p.m. in conjunction with the General Election. Residents can vote early Oct. 24 through Nov. 7 at the Sharp County Courthouse.

What is a millage rate and why do we need the increase?

A millage rate is a tax rate that, when multiplied against the assessed value of a taxable property, calculates the amount of property tax to be paid. It is one of the few ways a school district in Arkansas can secure additional funding for notable expenses such as construction. Arkansas’s uniformed rate of tax is twenty-five (25) mills, which is the state-required minimum. As of 2021, the state average millage is 38.93. In 2006, Highland’s millage rate increased from 28.3 mills to 30 mills. Then in 2020, voters supported the extension of the existing 5.0 mills so that we could continue operating at 30 mills.

The cost of school district operations has increased significantly since the last millage increase over 15 years ago. According to the Consumer Price Index published by the U.S. Bureau of Labor Statistics inflation since our last millage increase is up 68 percent. Yet, even as costs have increased, the patrons of the school district have continued to pay a millage rate that is well below the average rate in Arkansas and is, in fact, the third-lowest. The school district is diligent in its fiscal responsibilities. To fund the construction of a new high school with the support of state funding, we will still need an additional 8.9 mills, which brings us within the range of the state average millage rate.

What is the amount of tax due on the proposed 38.9 total mills, and what is the difference per year and per month from the current 30.0 total mills?

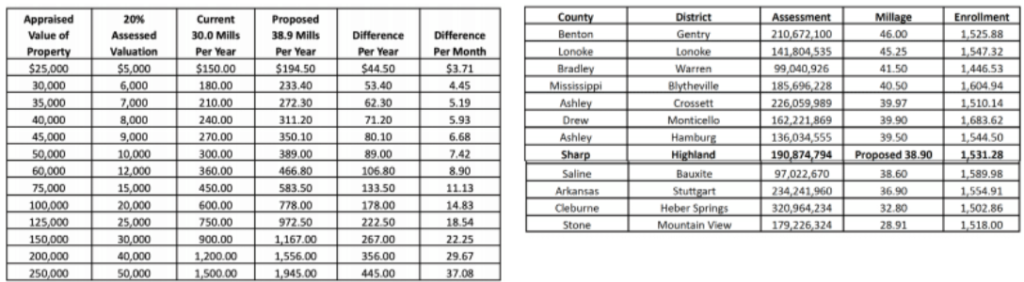

Below is a chart that includes a range of appraised property values, their assessed values, and a comparison of the fees associated with the current millage rates compared to the proposed millage rates. Individuals can calculate their property tax calculation using the following formula: Appraised Value * 20% * Millage (.0389) = Annual Tax

The same formula can be utilized for personal property that is assessed.

How does the District’s proposed millage rate compare to other school districts with similar enrollment?

When considering the reasonableness of a millage rate, it’s important to compare our district to those with similar enrollment numbers. It is important to recognize that districts that serve more students, especially in tight-knit communities like Highland, will require more funding when compared to similar-sized communities with fewer students.

I don’t have any kids in the school district—how will I benefit?

The school represents the heart of the community. There are countless studies correlating the quality of a community to education. Investments in education can reduce criminal activity by altering student behavior and improving labor market outcomes (Council of Economic Advisers 2016).

Safer, high-quality facilities also attract businesses and residents to live and work in the community. Further, in a small town like Highland, school facilities are utilized by residents of all demographics for events and gatherings. Highland views facilities as a resource to everyone who lives here.

Highland will be hosting several informational events and visiting with residents to ensure an informed vote on Nov. 8. Please reach out to one of the below listed contacts.

Jason Rhodes, School Board President [email protected].

Justin “Judd” Dunn, School Board Vice [email protected].

Johnny Carter, School Board [email protected].

Brandon Ryburn, School Board [email protected].

Renee Clay-Circle, School Board [email protected].

Dr. Julea Garner, School Board [email protected].

Dr. Austin Gilbreath, School Board [email protected].

Jeremy Lewis, [email protected].

John Sinclair, Assistant [email protected].

The first will be held on Mon. Sept. 19 at 6 p.m. at the high school cafeteria.